Do Insurance Companies Cover Trenchless Pipe Lining, And If So, Which Ones?

- Was your house built before 1975?

- Do you have cast iron drain lines?

- Do you have a sink, toilet, shower back-ups, or overflows?

- Do you have sinks, toilets, or showers that don’t drain properly?

- Do you have water damage to drywall, vanity, or door casings?

- Do you have water damage to flooring, broken tiles, or loose tiles?

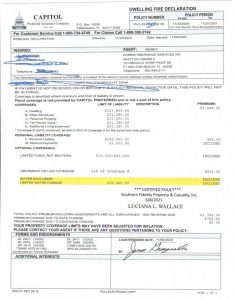

- Do you have a valid homeowner’s insurance policy?

If any of these apply to your home, then pipe replacement might be covered.

Specific insurance companies that may offer coverage for cast iron sewer pipe replacement include:

- State Farm

- Allstate

- Farmers Insurance

- Nationwide

- Liberty Mutual

- Progressive

- USAA (for military members and their families)

- Travelers Insurance

- American Family Insurance

- The Hartford

It’s important to note that the availability of coverage and specific policy details can vary between insurance companies and even within different policy types offered by the same company. It’s recommended to reach out to these companies or contact a local insurance agent to inquire about the specific coverage options and details related to cast iron sewer pipe replacement.

Whether or not insurance companies cover the cost of trenchless epoxy pipe lining will depend on several factors, including the specific insurance policy, the cause of the pipe damage, and the extent of the repairs needed.

Some insurance policies may cover the cost of trenchless epoxy pipe lining, but it’s important to check with your insurance provider to determine what is covered under your specific policy. Some policies may cover the cost of repairs for pipe damage caused by events such as natural disasters or accidents, while others may cover routine maintenance or preventative repairs.

Major insurance companies that may offer coverage for trenchless epoxy pipe lining include State Farm, Allstate, Geico, and Progressive, among others. However, the coverage and specific terms of each policy can vary widely, so it’s important to carefully review your policy and speak with your insurance provider to determine what is covered.

It’s also important to note that insurance companies may have specific requirements or recommendations for repair methods and contractors, so be sure to follow these guidelines to ensure that any repairs are covered by your policy.

In conclusion, whether or not insurance companies pay for trenchless epoxy pipe lining will depend on the specific policy and circumstances of the pipe damage. It’s important to check with your insurance provider to determine what is covered under your policy and to follow any guidelines or recommendations provided by your insurance company.

More Specifically

- Some insurance companies will only pay for the pipe replacement, not the actual excavation, the concrete replacement, or the floor surface repair.

- They will send out their own private adjuster to come and assess how much damage there is, and how much they will award you. It is important that you get what is known as a “public adjuster”. They won’t charge you a penny unless you are awarded damages by the insurance company.

- There are many benefits of using a public adjuster. For example, they know how to deal with unscrupulous insurance companies, and more importantly, they will attempt to obtain the value of pipe excavation, concrete replacement, and floor surface repair, which is typically around $70,000 for a 2,000-square-foot home, for which the adjuster will obtain a fee of 15 to 20% of that amount.

- Once you have received payment from the insurance company, you are free to use trenchless epoxy pipelining, which for a 2000-square-foot house only takes about three or four days, has a 50-year warranty, and costs about $20,000.

Should you get a public adjuster?

The answer is, absolutely! They are definitely worth the money given that the stakes are so large. The bigger the claim the more proficient insurance companies are at finding ways to deny claims. The public adjusters a truly a blessing in this industry.

They will gather all the information regarding damages and will recommend a sewer scope inspection, that will reveal the conditions of the cast iron pipes. The public adjuster will be able to technically describe the problems to the insurance company.

The average layman has no idea what they’re looking at when examining the Sewer Scope results. Insurance companies absolutely do, and they will find ways to pass the blame on to somebody or something else. So the experience of the public adjuster is absolutely essential for this type of claim. We highly recommend, however, that when choosing a public adjuster, you inquire whether they have had any experience with cast iron pipe claims.

Why do insurance companies deny cast iron pipe insurance claims?

These are some of the common reasons:

- The policy has special exclusion or endorsement that reads ”no coverage for cast iron pipe claims”

- The policy has a special endorsement that limits cast iron pipe damage claims to $10,000 or less

- The adjuster will cite language like “wear and tear”

- Caused by constant or repeated seepage or leakage of water

5 Steps You Should Take Immediately If Your Cast Iron Pipes Have To Be Replaced

Essentially, since 2016 insurance companies have created ways not to cover cast iron pipe claims. We usually recommend that the homeowner do a few things:

- Contact a plumber to video the line

- A temporary repair should be done so that the situation doesn’t get worse

- Call a water mitigation company to have any water damage taken care of so mold doesn’t develop or damages get worse

- Make sure you notify the insurance company–simply tell them you have a cast iron pipe damage claim you need to make and what the damages are so far

- Get a public adjuster

However, before contacting the insurance company I would highly recommend contacting a public adjuster so that you can talk about the claim and what rights you have under the homeowner’s insurance policy.

Finally, make sure you document all the damages by video and pictures. Take notes of any personal property damage, what the plumber told you, and the conversation with any representative from the insurance company.